We are combining our approach to alien clearing in the high mountain areas with the release of biocontrol agents. Biocontrol makes use of an invasive plant's naturally occurring enemies to reduce the invasive impact of the species. The approach reunites weeds with their naturally occuring enemies, thereby achieving more sustainable weed control. Biological control is best combined with other mechanisms (mechanical and chemical) to achieve a multi-pronged approach. We are specifically concerned with the prevalence of silky hakea in the upper mountain areas. In October 2020, we received training on the applicability of different biological control on silky hakea. The training was completed by Dr Wood from the Agricultural Research Institute. We have now ordered the appropriate hakea fungus which will assist with control across the conservancy. Information on some of the different control agents is available here.

0 Comments

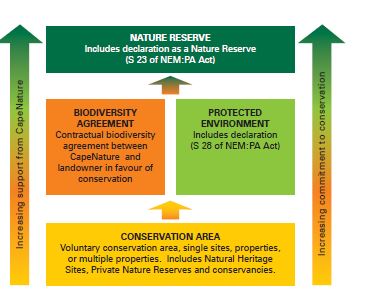

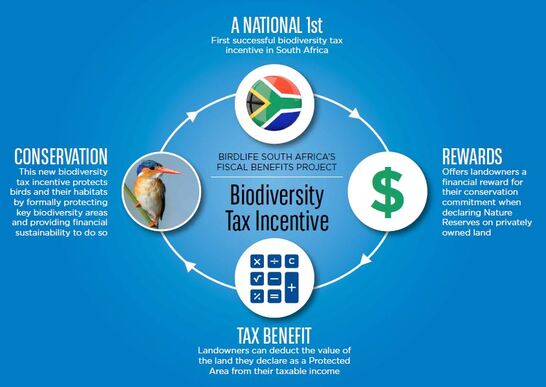

For the 2020 AGM, we are pleased to have guests who will discuss the Biodiversity Stewardship programme and associated tax incentives for landowners that formally commit to these agreements. The speaker will explain these different levels and incentives and the associated documents are available in advance or can be download after the AGM. In 2003, CapeNature created the Biodiversity Stewardship programme. This incentive was established to help landowners preserve and protect biodiversity on private land. CapeNature recognised that most of the province’s biodiversity is confined to private lands. The programme was designed to assist landowners who are committed to conservation on private land. A summary of these different levels can be found here. Fiscal TAx benefitsBirdlife launched the Fiscal Benefits Project to lobby SARS to revise aspects of tax legislation to assist landowners who commit to stewardship agreements and to engage with SARS on how these tax measures would be realized. The legislation has been in place since 2003 but there had been limited focus on how to claim these benefits. The incentive rewards landowners for their conservation commitment on private land. The incentives are only applicable for formally declared areas. Landowners can deduct the value of their protected land from their taxable income, thus reducing the tax owed. This tax incentive is globally unique and its successful inclusion in a tax return creates the first ever tangible, fiscal benefit as a reward for landscape level conservation. These benefits will be discussed and explained at the 2020 AGM but include:

Below is a link to the available files that further details these benefits.

|

AuthorGVB Conservancy Staff Archives

May 2024

Categories |

||||||||||||||||||||||||||||||||||||||||||

RSS Feed

RSS Feed